TLDR:

- Bitcoin is trading at $119,660, up 5.34% in seven days, but still below key $120K breakout level.

- Analysts warn that a daily close above $120K could trigger a rally toward $150K.

- Global liquidity change remains negative, pressuring Bitcoin’s momentum in recent sessions.

- Rejection at $120K could send Bitcoin down to the $111K demand zone.

Bitcoin is once again facing a major test near its all-time high. The cryptocurrency has been grinding toward $120K, but momentum has slowed. Traders are watching closely as global liquidity trends weigh heavily on risk assets.

Any decisive move from here could set the tone for Bitcoin’s next big leg. For now, the market is balancing hope for a breakout with caution over tightening monetary conditions.

Global Liquidity Change Signals Market Strain

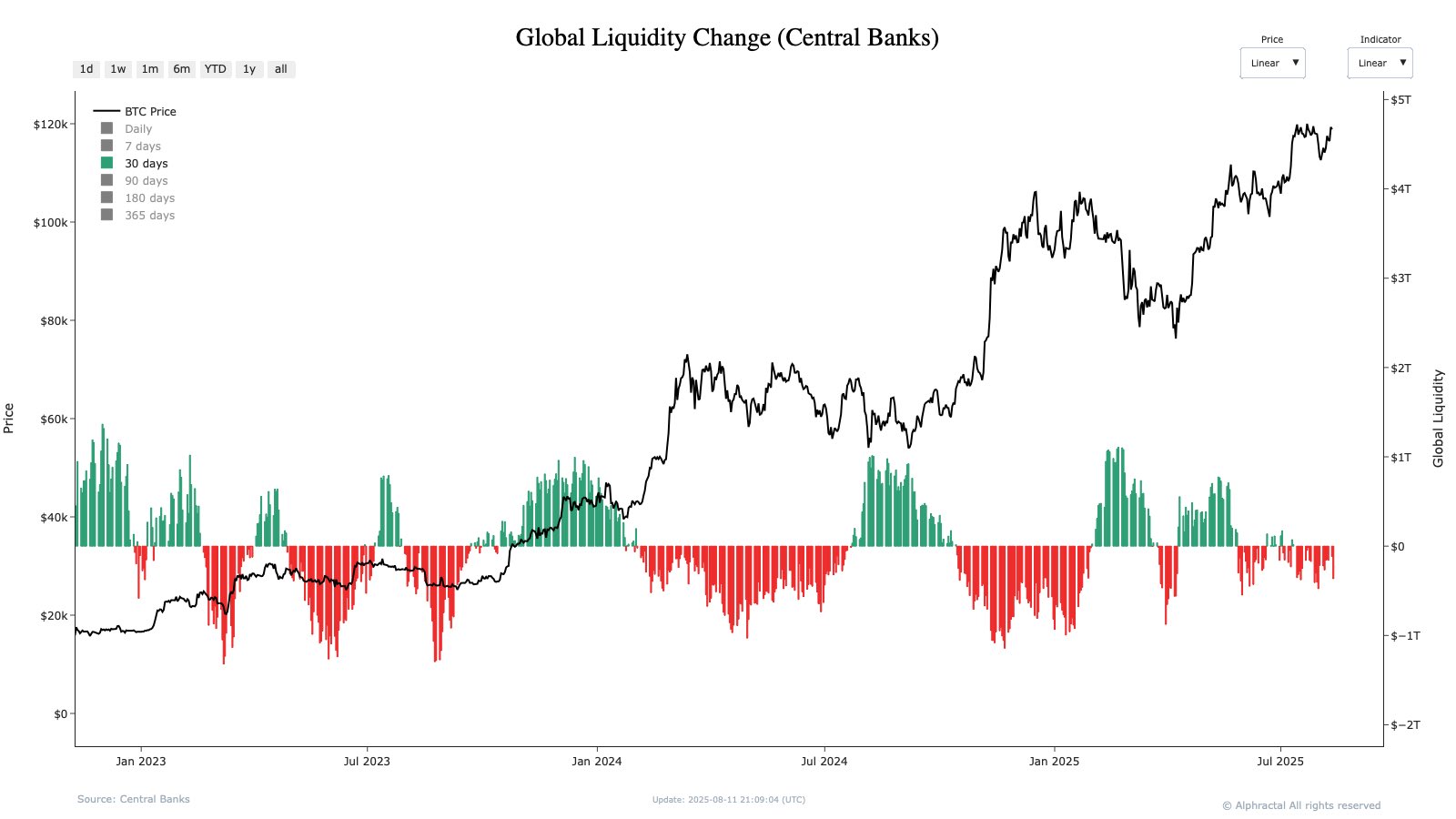

According to market analyst Boris (@Fundingvest), shifts in global liquidity have historically influenced Bitcoin’s price cycles.

When central banks expand monetary supply, capital often flows into assets like Bitcoin. Past surges in late 2023, mid-2024, and early 2025 reflected this pattern.

Global Liquidity Change, Source: X (formerly Twitter)

Global Liquidity Change, Source: X (formerly Twitter)However, liquidity contraction has repeatedly triggered slowdowns or pullbacks. Mid-2023 and late 2024 saw similar conditions, resulting in sideways trading or declines. That pattern is playing out again as global liquidity currently remains in negative territory.

Boris noted that if this contraction persists, Bitcoin could face deeper pullbacks. While short bursts of momentum have emerged in recent weeks, the overall structure still looks fragile. Sustained liquidity expansion may be necessary to support a strong rally from here.

Bitcoin Price Tests $120K With Mixed Signals

Crypto market commentator Crypto Patel observed that Bitcoin is trading just under its all-time high at $119.6K. Multiple rejections have occurred at this zone on the daily chart. Patel said a confirmed daily close above $120K could open the door to $150K.

#Bitcoin is grinding against its ATH resistance at $119.6K, multiple rejections on the daily close.

🔼 Daily close above $120K = breakout leg toward $150K

🔽 Rejection = possible sweep to $111K demand

Key zone: $120K daily close confirmation will decide the next macro move. pic.twitter.com/3Y5Vx7IjFX

— Crypto Patel (@CryptoPatel) August 13, 2025

The reverse scenario carries downside risk. A rejection at this resistance might pull price toward the $111K demand area. Traders have marked $120K as the defining level for Bitcoin’s short-term and macro direction.

Latest figures from CoinGecko show Bitcoin trading at $119,660 with 24-hour volume above $48.5 billion. This marks a 0.81% gain in a day and a 5.34% increase over the past week.

Market participants are split on the next move. Those focused on liquidity trends see limited upside without a policy shift. Others argue that strong buying pressure at current levels could fuel a breakout regardless.

If global liquidity turns positive, historical data suggests Bitcoin could accelerate higher. But as long as contraction dominates, rallies may remain unstable. For now, $120K is the pivot point that will determine whether the next major move is up or down.

BTC price on CoinGecko

BTC price on CoinGecko

3 months ago

9

3 months ago

9

English (US) ·

English (US) ·