The company strengthens its crypto reserves with a new purchase, aiming for increased yields in 2025.

Photo: Chris Kleponis/CNP/Bloomberg

Key Takeaways

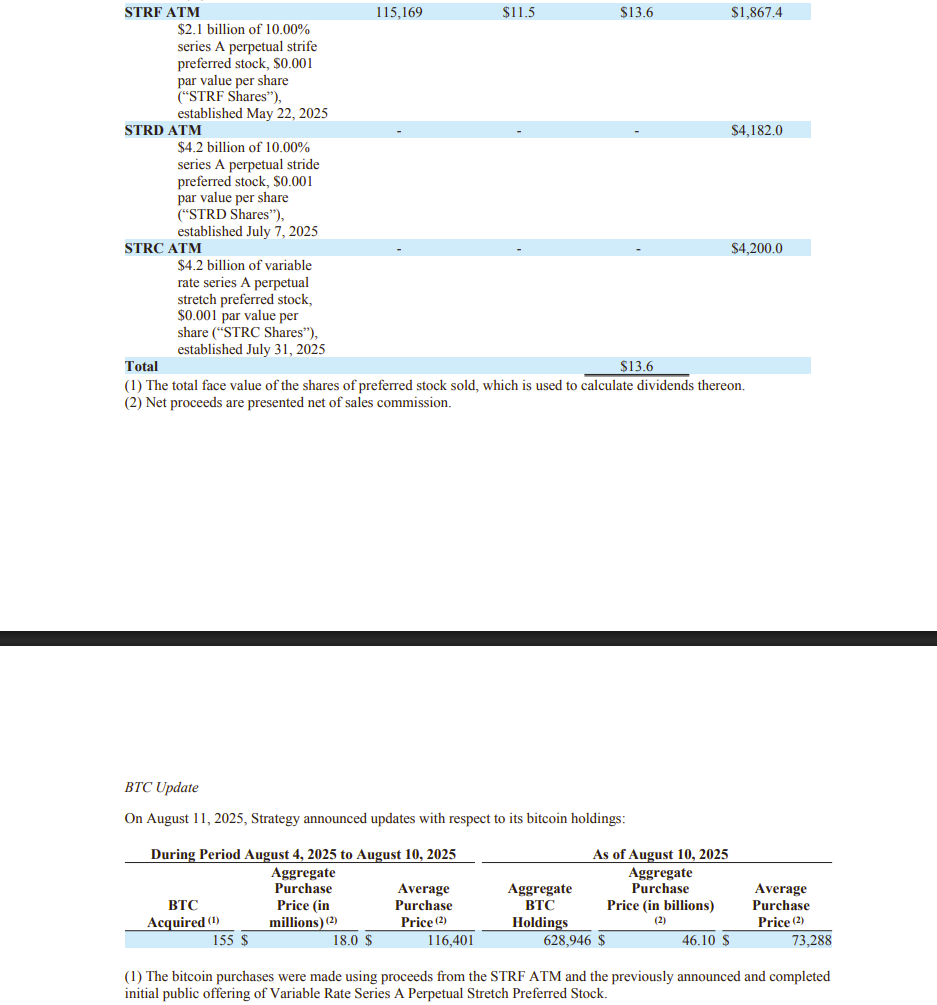

- Strategy purchased 155 additional Bitcoin for $18 million, increasing its digital asset holdings.

- The acquisition price equates to over $116,000 per Bitcoin.

Strategy, the world’s largest Bitcoin corporate holder, has resumed its BTC acquisition. The company announced Monday it had added 155 BTC to its treasury last week, its smallest purchase since mid-March.

Michael Saylor, the company’s Executive Chairman, dropped a hint about the acquisition yesterday. When Saylor puts out the Bitcoin tracker, it is often followed by an announcement within a few days.

If you don't stop buying Bitcoin, you won't stop making Money. pic.twitter.com/G9S2gPO1t8

— Michael Saylor (@saylor) August 10, 2025

The latest purchase, disclosed in an SEC filing, was made at an average price of $116,401 per BTC. Bitcoin briefly reclaimed $122,000 earlier today, according to TradingView.

Following the purchase, Strategy’s BTC holdings have grown to 628,791 BTC. With BTC now trading at around $119,500, the stash is valued at more than $75 billion, giving the company unrealized gains of about $29 billion.

Strategy financed its latest acquisition with proceeds from selling Series A Perpetual Strife Preferred Stock (STRF) and from the completed IPO of Variable Rate Series A Perpetual Stretch Preferred Stock. Between August 4 and 10, it sold more than 115,000 STRF shares, bringing in over 13 million dollars in net proceeds.

Strategy could potentially accumulate up to 7% of the global Bitcoin supply, as stated by Saylor. However, he insists on not aiming for total dominance, emphasizing a model that promotes decentralized participation in Bitcoin.

Saylor ardently supports the growth of Bitcoin corporate adoption and the decentralization ethos of the crypto ecosystem.

Disclaimer

3 months ago

25

3 months ago

25

English (US) ·

English (US) ·