Institutional demand and aggressive accumulation are fueling record inflows, signaling growing confidence in Ethereum’s long-term outlook.

Key Takeaways

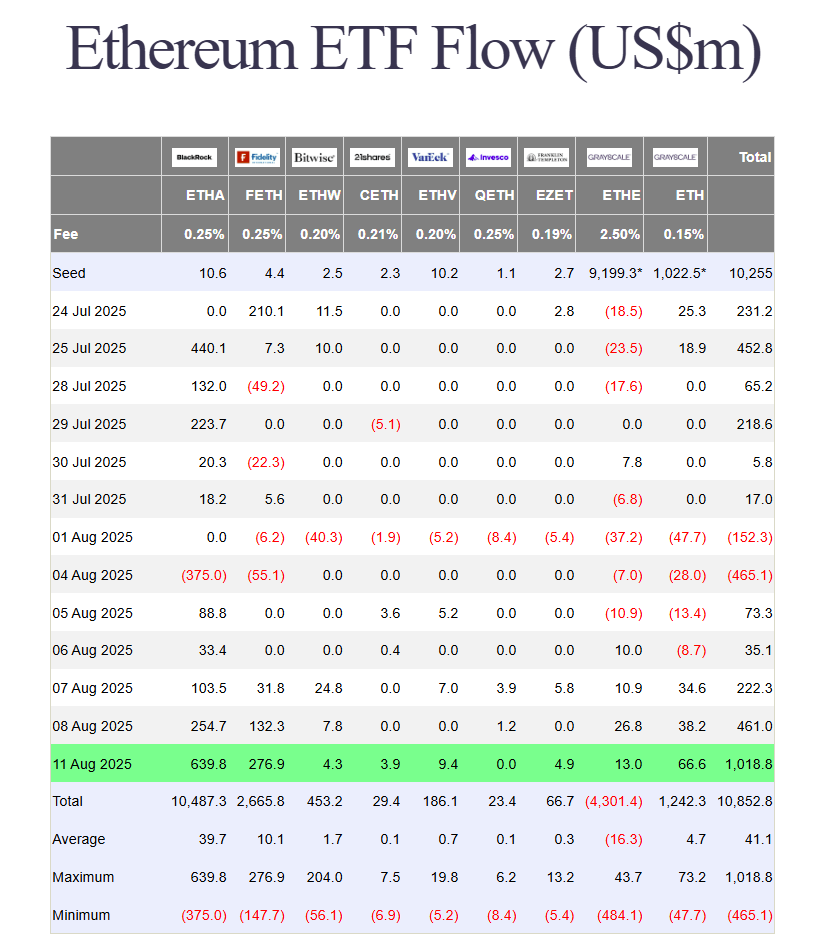

- Spot Ethereum ETFs recorded over $1 billion in daily net inflows, their highest since last July.

- Investor interest in Ethereum exposure through ETFs is rising as ETH trades around $4,300.

US-listed spot Ethereum ETFs listed in the US pulled in more than $1 billion in net inflows on Monday, their highest daily total since debut, according to data tracked by Farside Investors.

BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH) also posted their largest single-day inflows, drawing about $640 million and $277 million, respectively. Except for Invesco’s fund, all other Ether ETFs posted positive results.

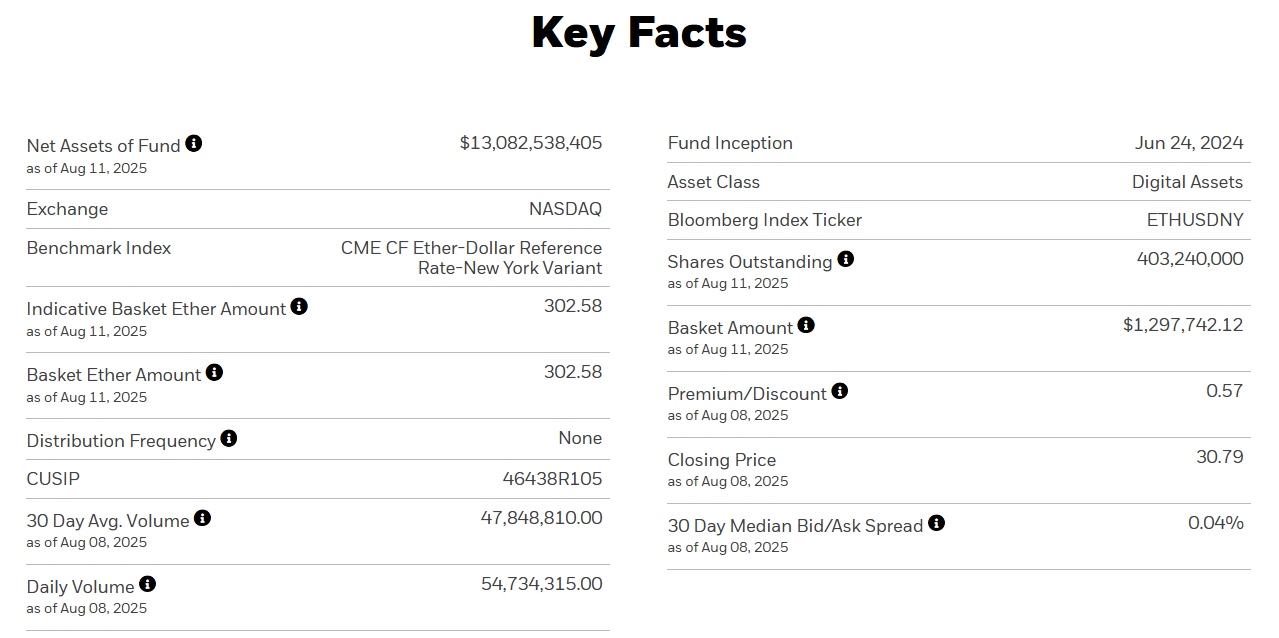

BlackRock has maintained its top position, with assets under management exceeding $13 billion as of August 11.

Monday’s gains pushed Ethereum funds into a five-day winning streak. Their longest winning streak on record took place between July 3 and July 31.

The strong performance came as ETH hovered around $4,300, its highest level since December 2021. The digital asset is now around 12% away from its all-time high of $4,868 set in November 2021 during the bull run market, TradingView data shows.

Ethereum’s price surge comes amid aggressive accumulations from publicly traded companies, such as Tom Lee’s BitMine and SharpLink Gaming.

Furthermore, on Monday, Fundamental Global, soon to be renamed FG Nexus, which recently filed a $5 billion shelf registration with the SEC to expand its Ethereum accumulation strategy, announced it had acquired 47,331 ETH as part of its ambition to take a 10% stake in the network.

Disclaimer

3 months ago

21

3 months ago

21

English (US) ·

English (US) ·