The European Union is quietly preparing retaliatory trade measures against China, and the trigger appears to be Beijing’s threat to restrict exports of rare earth materials. But the EU’s counterstrike could hit closer to home by expanding controls on semiconductor tooling, with ASML's DUV machines under consideration for a retaliatory ban.

According to a recent report by Bloomberg, Brussels officials have begun mapping out “trade options” should diplomacy fail, amid growing frustration over asymmetric pressure tactics from Beijing. In other words, if China weaponizes rare earths, the EU might respond by tightening controls over legacy chip tools still flowing to Chinese fabs. That would put ASML — the only company in the world that can supply EUV scanners and one of just three capable of building advanced DUV machines — in an impossible position.

25% of revenue on borrowed time

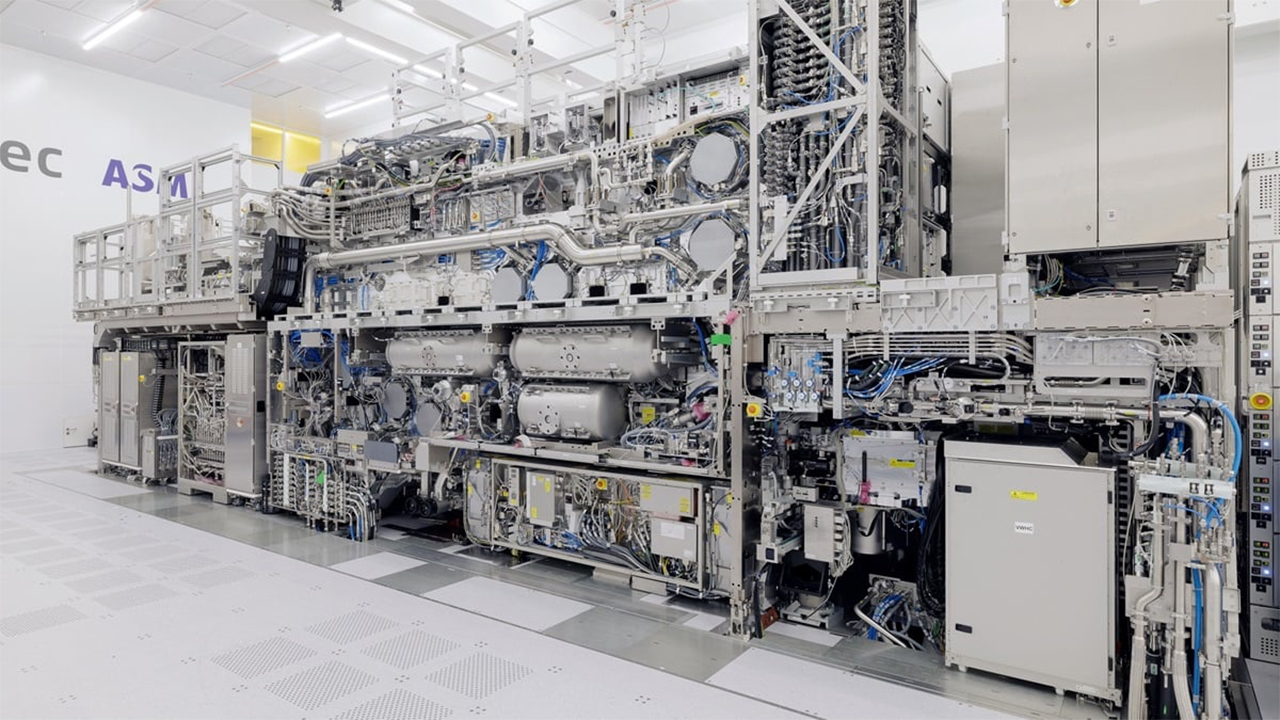

In Q3 2025, ASML generated €2.4 billion in sales from China, accounting for 42% of system sales revenue and just over 25% of total revenue. More than 90% of those Chinese orders were for DUV systems like the Twinscan NXT:2000i and NXT:1980Di platforms, both of which remain exportable under current Dutch rules.

Unlike ASML’s EUV tools, which are already banned for export to China, these immersion DUV machines are used to fabricate chips on older nodes, and are critical to everything from automotive MCUs to AI accelerators built on older logic.

While the current licensing regime already restricts EUV exports, Dutch authorities have made clear that the same controls could eventually extend to advanced DUV systems. Those tools are not exempt by default — they’ve simply been licensed on a case-by-case basis, and that door could close if diplomatic talks with Beijing break down. Bloomberg's report confirms Brussels is actively weighing those options, with trade officials mapping out escalation scenarios in parallel with attempts to de-escalate.

A full EU ban on DUV exports could force ASML to walk away from a quarter of its revenue overnight. While ASML has told investors it expects 2026 sales to hold steady even with a decline in China-bound shipments, that guidance assumes a controlled taper, not a blanket ban.

Additionally, ASML continues to fulfil DUV orders that were secured before licensing rules tightened, many of which came from Chinese foundries racing to build up capacity while they still can. If those orders are cancelled or blocked midstream, the company could be left with idle capacity or orphaned inventory that isn’t easily redirected.

It’s tempting to write off DUV as yesterday’s technology. EUV gets all the attention, especially as TSMC and Intel push toward 2nm and beyond. But for China’s domestic foundries — SMIC, HuaHong, Nexchip, and others — DUV is the workhorse platform. Even Huawei’s Kirin 9000S, fabricated at a nominal 7nm, was likely stitched together using multi-patterned DUV.

The problem is that while China has developed domestic alternatives for some fab gear, it still lacks a credible substitute for ASML’s DUV steppers. Canon and Nikon, the other two players in the DUV space, are either capacity-limited or unwilling to challenge Dutch export policy. That leaves Chinese fabs with few options, particularly for immersion lithography.

Deepening tech isolation

The risk now is that the EU, under pressure to act, chooses to pull the DUV lever. That would deepen China’s tech isolation, but also accelerate the buildout of domestic alternatives. SMEE, China’s state-backed lithography firm, has already shipped early-generation tools and is working on immersion platforms.

Meanwhile, SMEE spinoff AMIES recently showcased its latest lithography equipment at an industry event in Shenzhen. Even if performance is years behind, China has shown a willingness to subsidize inefficient infrastructure for the sake of supply chain resilience.

For ASML, cutting off China means forfeiting a quarter of its revenue and potentially triggering retaliatory action against its installed base of thousands of tools currently running across Chinese fabs, which all depend on ASML parts and servicing. But continuing shipments risk running afoul of Brussels and Washington at a time when both are scrutinizing supply chains more closely than ever.

Unfortunately, ASML is stuck between a rock and a hard place. A full ban would hurt China in the short term, but hand it a longer-term incentive to accelerate tooling independence. It would squeeze ASML’s financials just as demand from customers in the West begins to normalize. And it would force the Netherlands to pick sides in a trade war it didn’t start.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

2 weeks ago

4

2 weeks ago

4

English (US) ·

English (US) ·