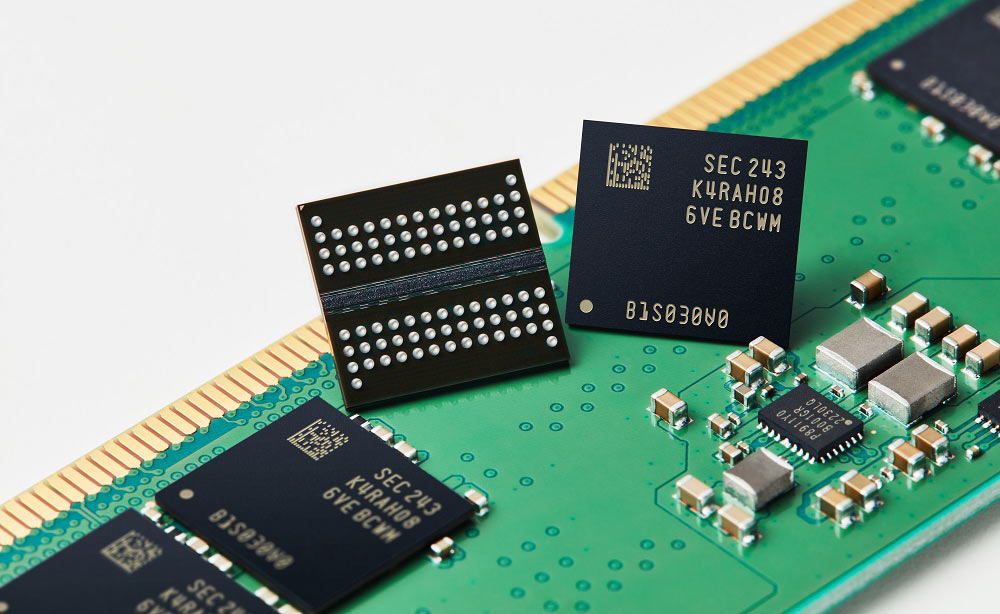

For the first time in history, last-gen's DRAM has soared to over double the price of the current generation. The price of DDR4 modules is rapidly outpacing that of DDR5 modules, thanks to a perfect storm of tariff fears and stock uncertainty.

According to TrendForce, some DDR4 kits and configurations have increased by up to 40% in the last week alone, rapidly widening the gap between DDR4 and DDR5 prices. The spot price for DDR4 16Gb (1Gx16) at 3200 MHz from Samsung/SK hynix grew to an average price of $12.50 via DRAMeXchange, with highs reaching $24.00. Comparatively, the price for DDR5 2x8G modules at 4800/5600 MHz has stuck close to $6, with daily highs only hitting $9.

Never before have we seen the outgoing generation of DDR memory chips surge this high on their way out. The rapid growth spurt for DDR4's trade value comes shortly after Micron announced its exit from producing new DDR4 memory modules this year. Micron's DDR4 lines are entering end of life, with the firm to wind down production over the next 6-9 months.

The firm is one of the final dominoes for DDR4 to fall, as a few memory producers have priced most of the major producers out of building more DDR4 chips. Micron joins Samsung, which announced its imminent DDR4 retirement in April, citing a need to focus on incredible demands for DDR5 and HBM production. Chinese firm CXMT also teased the end of its DDR4 production, even though the firm just reached peak DDR4 production.

Taiwanese DRAM firm Nanya stands to win big in this topsy-turvy DDR4 market. The firm is one of the largest suppliers of DDR4, currently. Recent reports found that in Q1, Nanya's DDR4 inventory was worth a staggering NT$37.6 billion ($1.2 billion USD), and while this was initially thought to be a major money pit for the company, recent upturns in prices have left Nanya standing on top. The firm recently stopped DDR4 spot price quotes as prices began to climb, leaving them ready to sell high.

Samsung, SK hynix, and Micron are now reportedly raising their prices to their customers for their last-ever waves of DDR4, so it's likely this will cause the bubble to continue growing. On top of this, tech industry tariff concerns have left things uncertain enough to spark some panic buying.

The U.S. government's trade interventionism with China is well-documented, and many speculators believe the current administration will see China's huge existing output of DDR4, ready to capitalize on the price hikes, and level retaliatory tariffs to cinch supply from the nation. This would send DDR4 prices even higher — likely to more than triple the cost of DDR5.

In a market dominated by DDR5 and HBM memory demand, it's easy to forget that the average consumer is not chasing the newest memory in quite the same way. DDR5 adoption accounts for only 60% of new notebook models, with many laptop buyers happy to stick with the older generations because they (used to) cost less, and the technology is more mature (more reliable). This means many laptop OEMs are still looking to source DDR4 memory to pair with, for example, Intel's older Raptor Lake chips, which are currently outselling newer generations in an embarrassing fashion. Unfortunately, it looks like this money-saving hack may be ending, as DDR4 laptops may soon cost more.

6 months ago

18

6 months ago

18

English (US) ·

English (US) ·