Intel CEO Lip-Bu Tan has swiftly become a controversial figure in the political and technology space following his appointment in March this year. Off the back of an aggressive restructuring and layoff program, which has seen Intel scale back its ambitions in a number of industries, he's drawn attention for his heavy investments in Chinese companies - some 600 in total - a number of which allegedly have ties to the Chinese military. Lately, he was even called to the White House to face down the President, who called for his resignation, though that demand was later walked back following the meeting.

Born in what is now Malaysia and educated in Singapore, Tan moved to the United States in the 70s and studied business administration. He would later go on to become a founder of the venture capital firm Walden International in the late 1980s. During his tenure there, he focused its funding on startups in Asia, and was an early investor in the partially-state-owned Semiconductor Manufacturer International Corporation (SMIC), which is now the largest chip manufacturer in China.

That didn't stop last century, either. In 2023, the House Select Committee on the Chinese Communist Party sent a letter to Tan raising what was described as "serious concerns" over his VC firm's investments in various Chinese semiconductor, quantum computing, and artificial intelligence companies. Some of those companies had even been blacklisted by the U.S. Commerce Department for their human rights abuses and Chinese military links, as WSJ reported earlier this year.

Tan reportedly made at least 25 investments in Chinese chip companies between 2017 and 2020, too, accounting for more than 40% of Chinese semiconductor deals coming from US companies during that time, WSJ found in 2021.

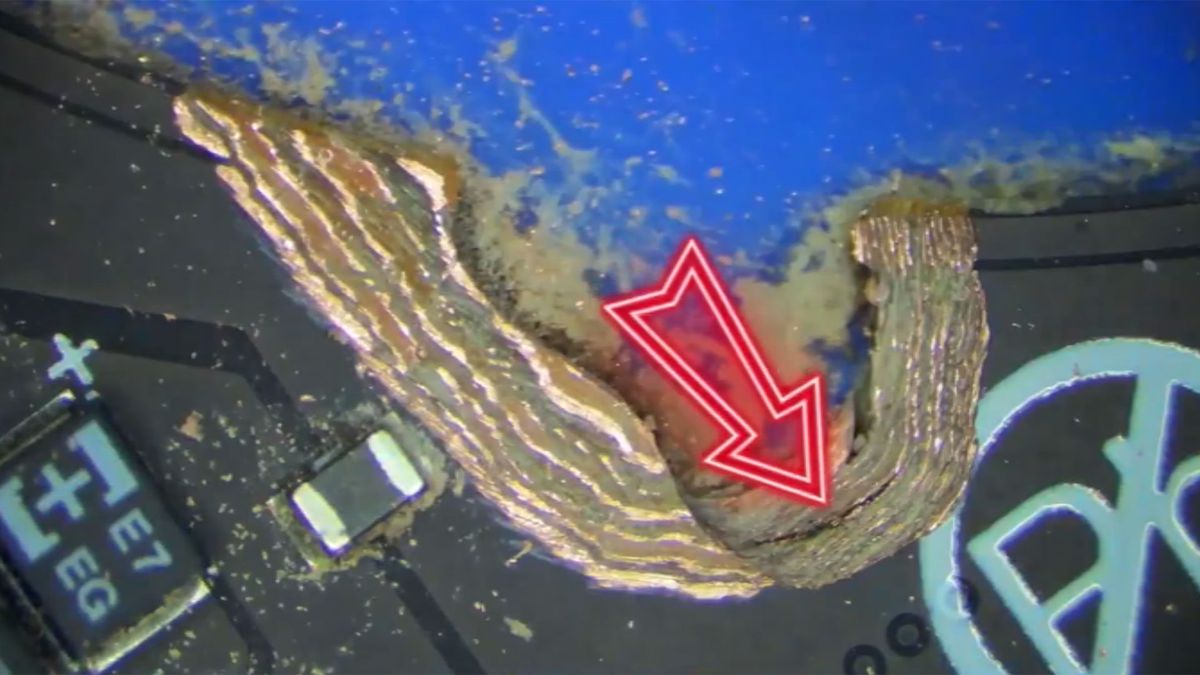

Tan has also drawn concern from a range of parties for his involvement with the American semiconductor and integrated circuit design company, Cadence Design Systems. Tan was CEO between 2008 and 2021, and then executive chairman until 2023. Cadence recently admitted to selling chip design software to Chinese companies with military ties over a period of many years during Tan's tenure, and will pay a $140 million fine as a result.

This all came to a head last week when Senator Tom Cotton, R-Ark, raised concerns about Tan's ties to Cadence and pushed for Intel to confirm he had been required to divest from his interests in Chinese companies as part of his appointment at the company. Cotton questioned whether Tan could be responsibly trusted to handle the huge investments Intel had benefited from as part of the nearly $8 billion it would receive as part of the CHIPS Act grant.

This was followed by condemnation from President Trump, who called on Tan to resign at the end of last week, saying he was "highly conflicted." However, following the meeting between the pair on Monday at the White House, Trump changed his tune.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

“The meeting was a very interesting one. His success and rise is an amazing story," he posted on his social network, Truth Social. "Mr. Tan and my Cabinet members are going to spend time together, and bring suggestions to me during the next week."

Intel's public statements claim that it and Tan are "deeply committed to advancing U.S. national and economic security interests." It also claimed that it was aligning its investments with the "President's America First agenda," in a line that echoes statements made by many other US companies that have found themselves in the President's firing line in the past half year.

As for Tan himself, he posted a message to Intel staff on August 7, stating: "I want to be absolutely clear: Over 40+ years in the industry, I’ve built relationships around the world and across our diverse ecosystem – and I have always operated within the highest legal and ethical standards. My reputation has been built on trust – on doing what I say I’ll do, and doing it the right way. This is the same way I am leading Intel."

Intel stock prices jumped shortly after the news of a positive White House meeting, though questions still remain about Tan's Chinese ties and how divested he is from his linked investments, if at all.

4 months ago

21

4 months ago

21

English (US) ·

English (US) ·