Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

Bottom line: The NAND flash industry is facing mounting pressure due to a combination of weak demand, oversupply, and declining prices. This challenging market environment has persisted throughout the year, forcing memory manufacturers to reassess their production strategies. However, industry experts believe that despite the current downturn, the second half of 2025 could bring signs of recovery as demand stabilizes and supply adjustments take effect.

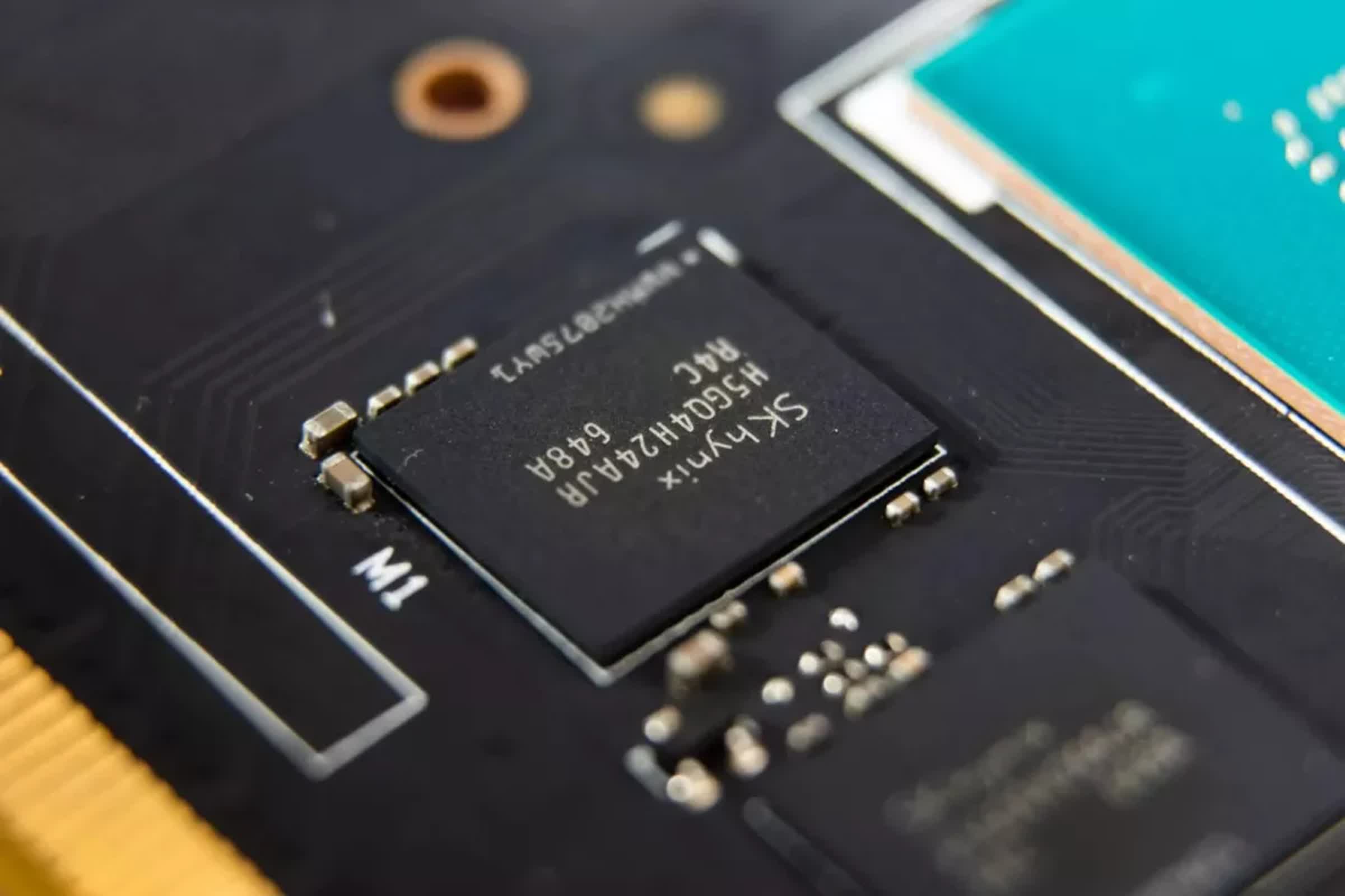

The oversupply of NAND flash has forced memory chipmakers to implement production cuts in response to lower-than-expected orders from PC and smartphone manufacturers. Major players in the industry, including Micron, Kioxia/SanDisk, Samsung, and SK hynix/Solidigm, have all announced plans to scale back their manufacturing operations.

This strategy aims to bring supply in line with the revised demand forecasts, which, according to TrendForce, have been adjusted downward from an annual growth rate of 30 percent to a more modest 10 percent to 15 percent for 2025. The production cuts should lay the groundwork for a price recovery, according to the publication.

The current market conditions have led to a continuous decline in NAND flash prices. According to a LinkedIn post by memory distributor Memphis Electronic, flash memory prices have fallen for four months in a row, driven by a decline in purchases from key buyers such as smartphone and laptop makers, which the company identifies as the main consumers of NAND flash.

Shrish Pant, a director analyst and technology product leader at Gartner, told The Register that NAND flash pricing will remain weak for the first half of 2025 but projects higher bit shipments for SSDs in the second half of the year.

Several factors are expected to contribute to a potential market recovery in the latter half of 2025. The increasing demand for enterprise SSDs, driven by Nvidia's Blackwell-series products and advancements in AI server deployment, is expected to boost the market. In the long term, AI demand will continue to drive the demand for higher-capacity/better-performance SSDs, Pant said.

Additionally, China's trade-in subsidy policies have stimulated smartphone sales, accelerating the depletion of NAND Flash inventory. Nvidia's Project Digits, featuring 4TB SSD-equipped systems, is poised to drive demand for higher-capacity PC SSDs.

Furthermore, DeepSeek's breakthroughs in reducing computational power requirements are expected to accelerate the adoption of AI-enabled smartphones, potentially increasing storage demand.

However, Pant concludes that the memory market remains subject to periodic fluctuations, with NAND flash prices continuing to follow a cyclical pattern based on hyperscalers' buying behavior.

English (US) ·

English (US) ·