Top hyperscalers and Nvidia clients have begun a prolonged divorce from the AI giant. According to industry reports, purchases of ASICs (application-specific integrated circuits) are projected to rise at a compound annual growth rate of 50%, with much of this growth coming from companies like Microsoft, Google, and Amazon's AWS, all seeking to start work on in-house ASIC development.

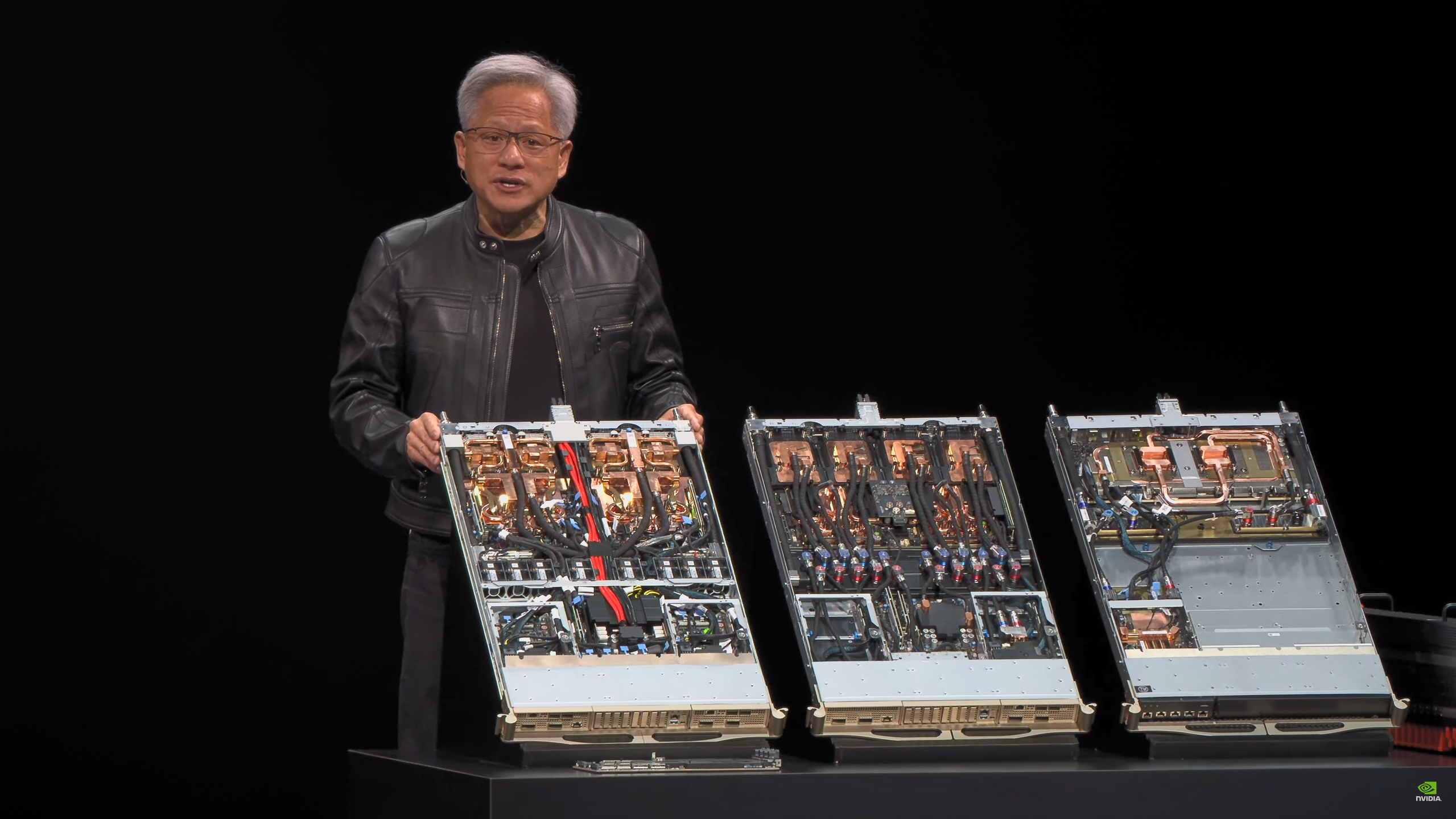

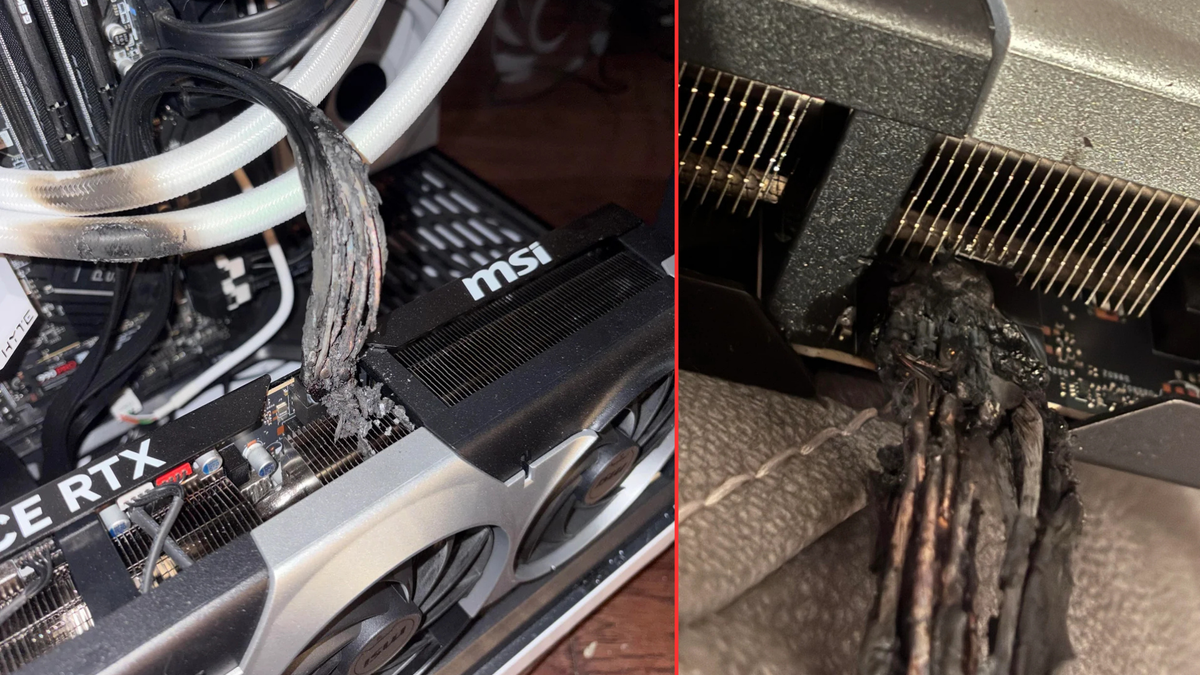

ASICs are one of the largest competition vectors to Nvidia's robust hardware and software stack for enterprise computing in the AI era. Nvidia's server hardware is prolific across the industry, with its Blackwell GPUs like the B200 quickly filling data centers worldwide. But with Nvidia's chips costing $70,000 to $80,000 each, and with full-server configs of the GB200 running between $1.8 million and $3 million, it is certainly no surprise that enterprise-scale clients are looking to reduce dependency on such a pricey partner.

Per reports, these top cloud partners of Nvidia are continuing to order hardware from Nvidia. The companies are also ramping up orders of ASIC hardware and reserving production space at TSMC, the world's largest contract chip fabricator. It will be a long-term goal to fully divorce from Nvidia, a company that holds not only hardware dominance but software as well, thanks to its insular CUDA workflow. But the major clients are seemingly beginning the path to hardware independence through in-house ASIC designs, while continuing to buy from Nvidia for the time being.

While a reliable option in the past would be to buy or design ASICs from top ASIC makers like MediaTek or Qualcomm, these companies are now also joining forces with Nvidia. Thanks to Nvidia's NVLink Fusion initiative, a plan to allow customers and ASIC partners to use the company’s NVLink technology in their own products, thus enabling seamless overlap between Nvidia hardware and third-party ASIC-based servers, Nvidia has built new partnerships with much of the ASIC market. MediaTek, Marvell, Alchip, Astera Labs, Synopsys, Cadence, Fujitsu, and Qualcomm have all entered into partnerships with Nvidia via NVLink Fusion.

TSMC, as the company responsible for fabricating both Nvidia's hardware and new ASIC designs from the top hyperscalers, only stands to continue winning big amidst the protracted divorce. In an iconic recent press statement, TSMC chairman C. C. Wei shared, "It doesn't matter who wins — both Nvidia and the ASIC players are our customers. They're all manufactured at TSMC."

This move toward custom ASIC-based server solutions for server graphics and AI compute follows a trend among major hyperscalers like Amazon and Google towards custom, in-house silicon. Many of the top server rental companies have invested big into custom Arm-based chips in their server stacks; 50% of Amazon's new servers are currently running on its custom AWS Graviton Arm-based processor family. As time goes on and the ASIC-based move away from Nvidia continues, it will be interesting to see how fractured the top-end of compute will become.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

6 months ago

21

6 months ago

21

English (US) ·

English (US) ·