Late on Tuesday, AMD announced its financial results for the first quarter of fiscal 2025, posting its highest quarterly revenue ever. The company's results were driven by sales of expensive client and datacenter CPUs as well as improved sales of Instinct MI300-series AI accelerators. However, the company's gaming earnings dropped mainly due to the slowdown of console sales. But while the company's revenues in Q1 set records, AMD warned that the U.S. export tariffs may hit its sales by around $1.5 billion in 2025.

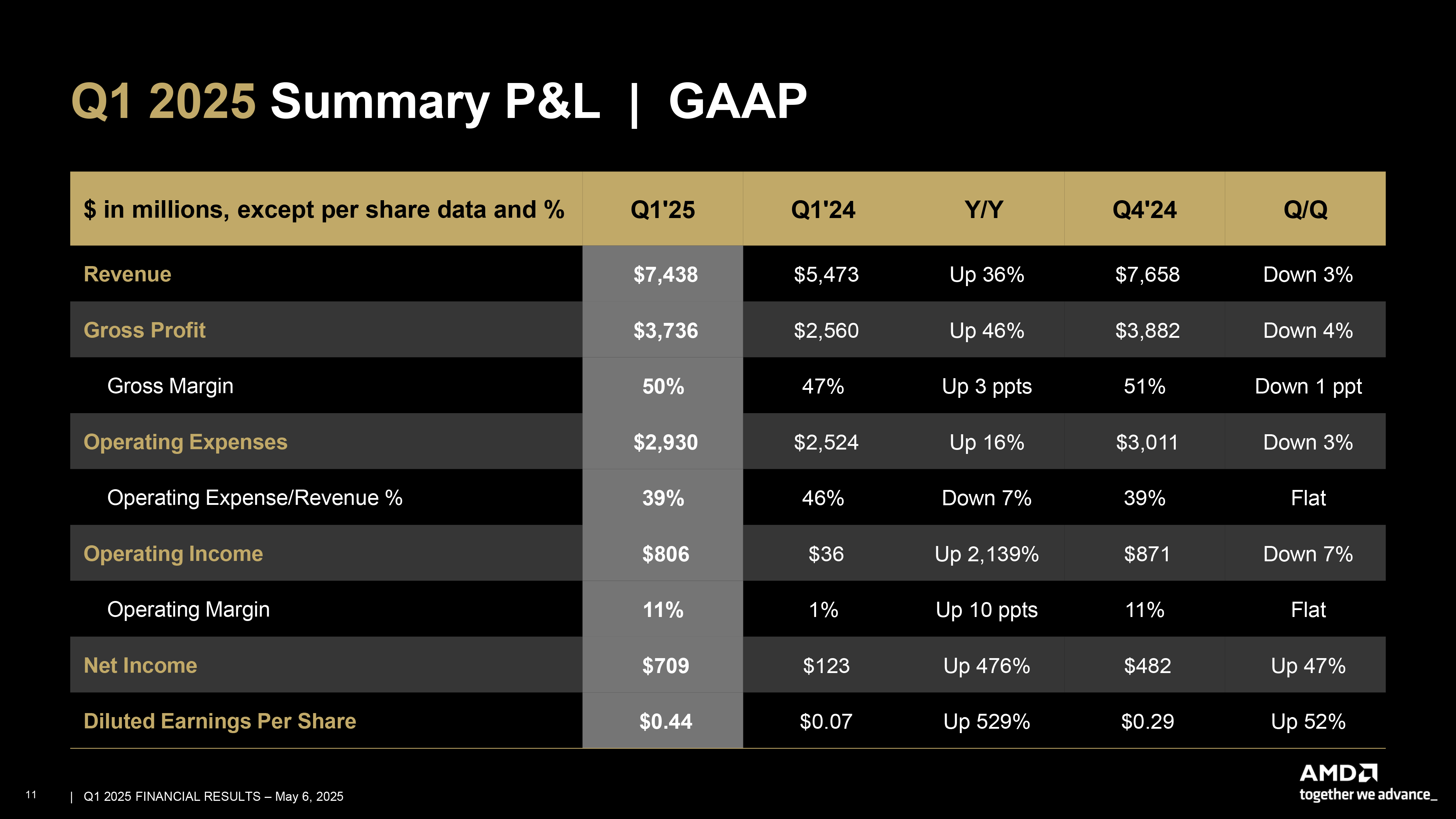

AMD posted a revenue of $7.438 billion for the first quarter of 2025, up 36% year-over-year. When it comes to earnings, this is the best quarter posted by AMD throughout its history. In fact, it is more than AMD earned for the whole year 2019. AMD's gross profit totaled $3.736 billion, whereas its net income achieved $709 million for the quarter (up a whopping 2,139% for the same quarter a year ago) as its gross margin hit 50%.

"We delivered an outstanding start to 2025 as year-over-year growth accelerated for the fourth consecutive quarter driven by strength in our core businesses and expanding data center and AI momentum," said Dr. Lisa Su, AMD chair and CEO. "Despite the dynamic macro and regulatory environment, our first quarter results and second quarter outlook highlight the strength of our differentiated product portfolio and consistent execution positioning us well for strong growth in 2025."

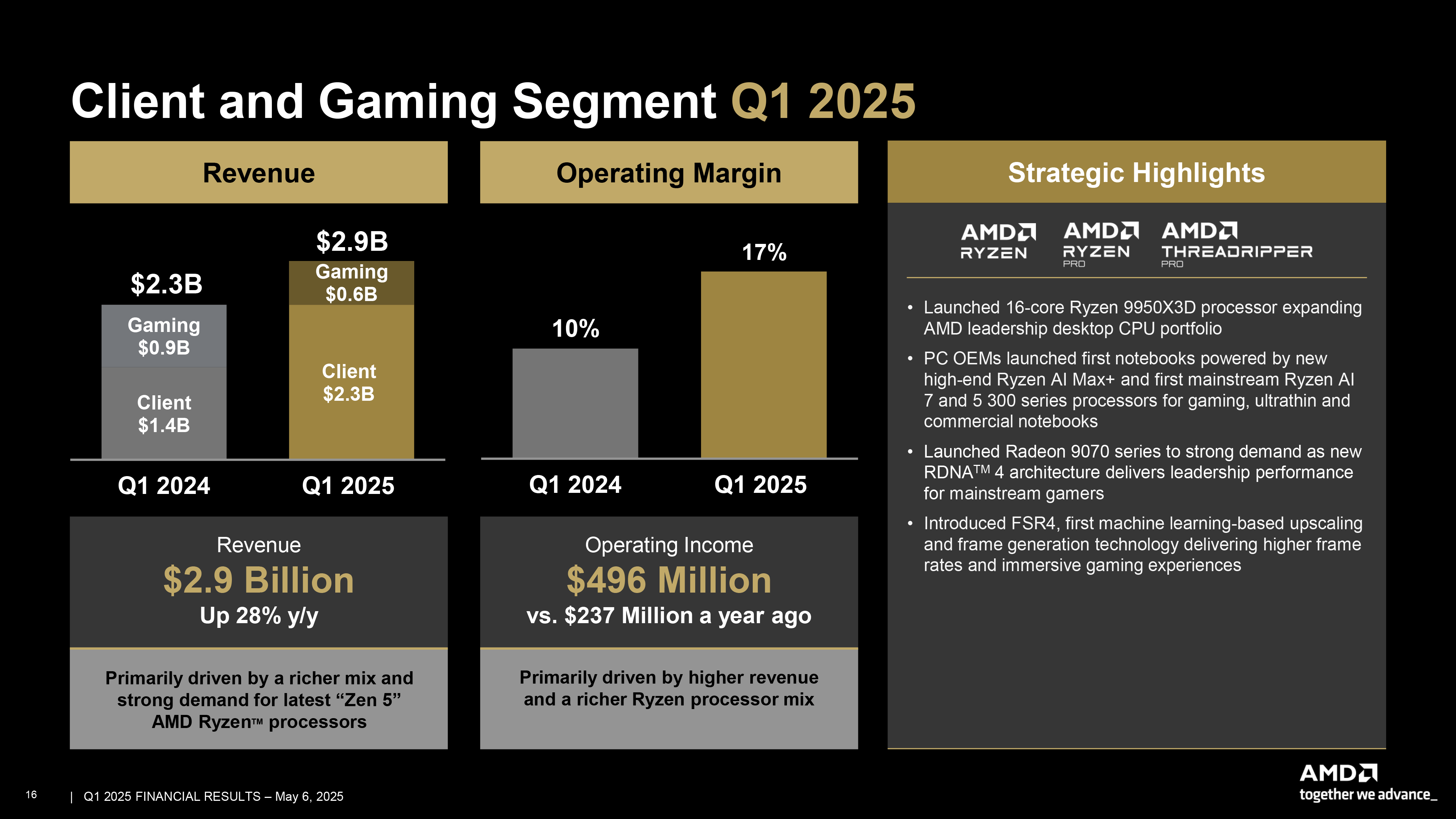

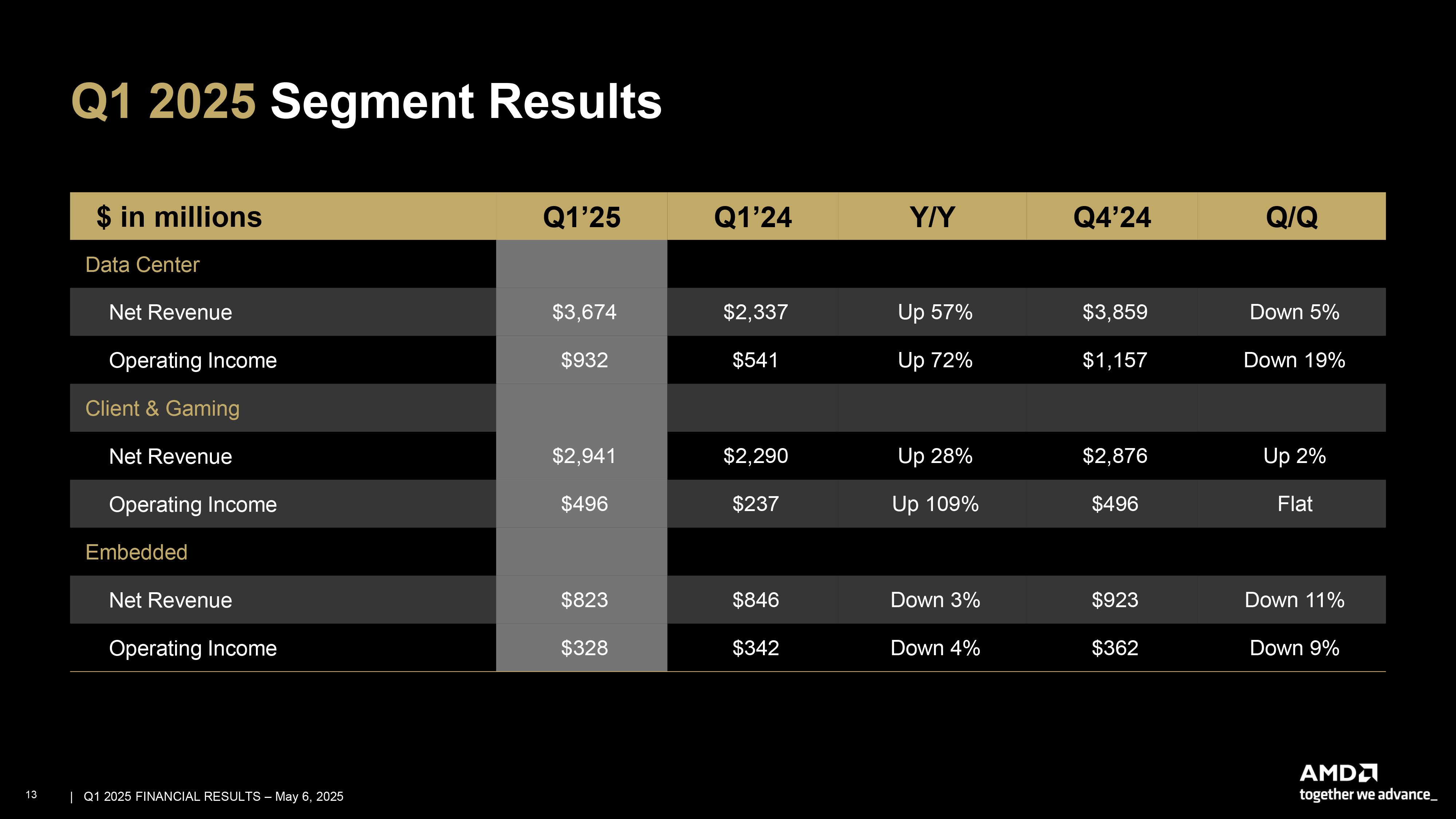

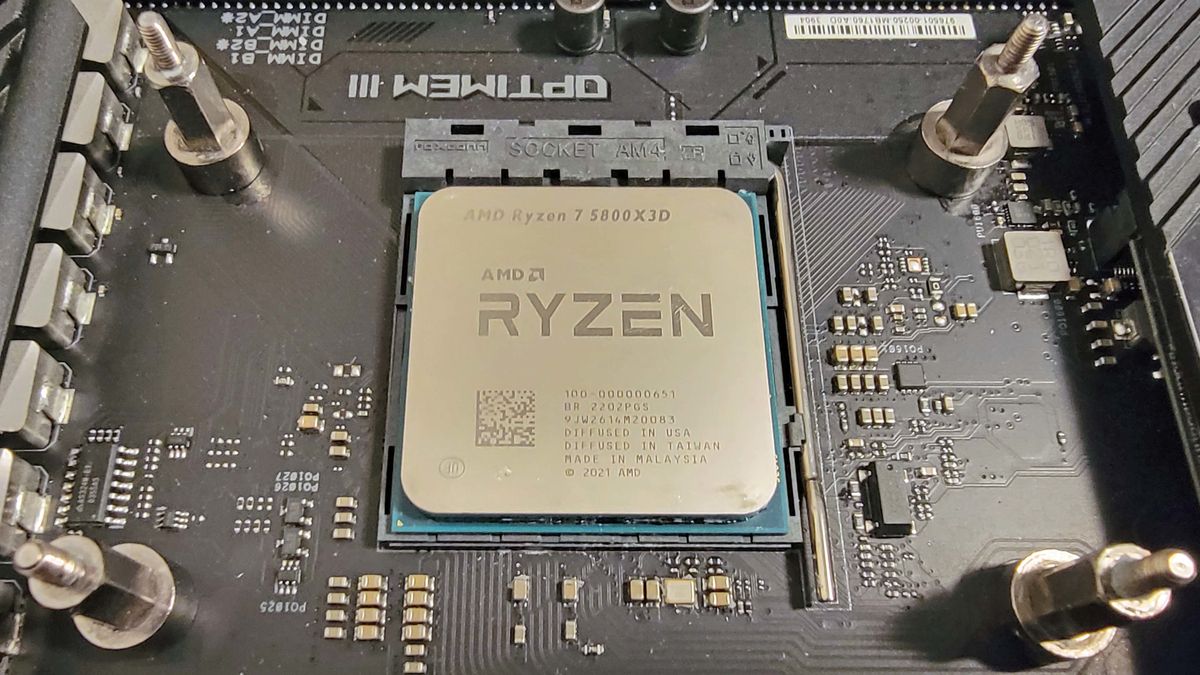

In the first quarter, AMD's Client and Gaming division generated $2.9 billion in revenue, reflecting a 28% increase compared to the same period last year. The Client subsegment contributed $2.3 billion, marking a 68% rise year-on-year, largely fueled by high interest in the latest generation of Ryzen AI processors and a product mix that included more premium parts (such as Ryzen 9000 X3D for desktops and Ryzen AI 300-series for laptops).

In contrast, revenue from the Gaming subsegment declined 30% to $647 million, mainly due to reduced contributions from AMD's semi-custom system-on-chips for Microsoft Xbox and Sony PlayStation game consoles. Nonetheless, AMD expressed optimism about sales of its latest Radeon RX 9070-series graphics cards for desktop PCs based on the RDNA 4 architecture.

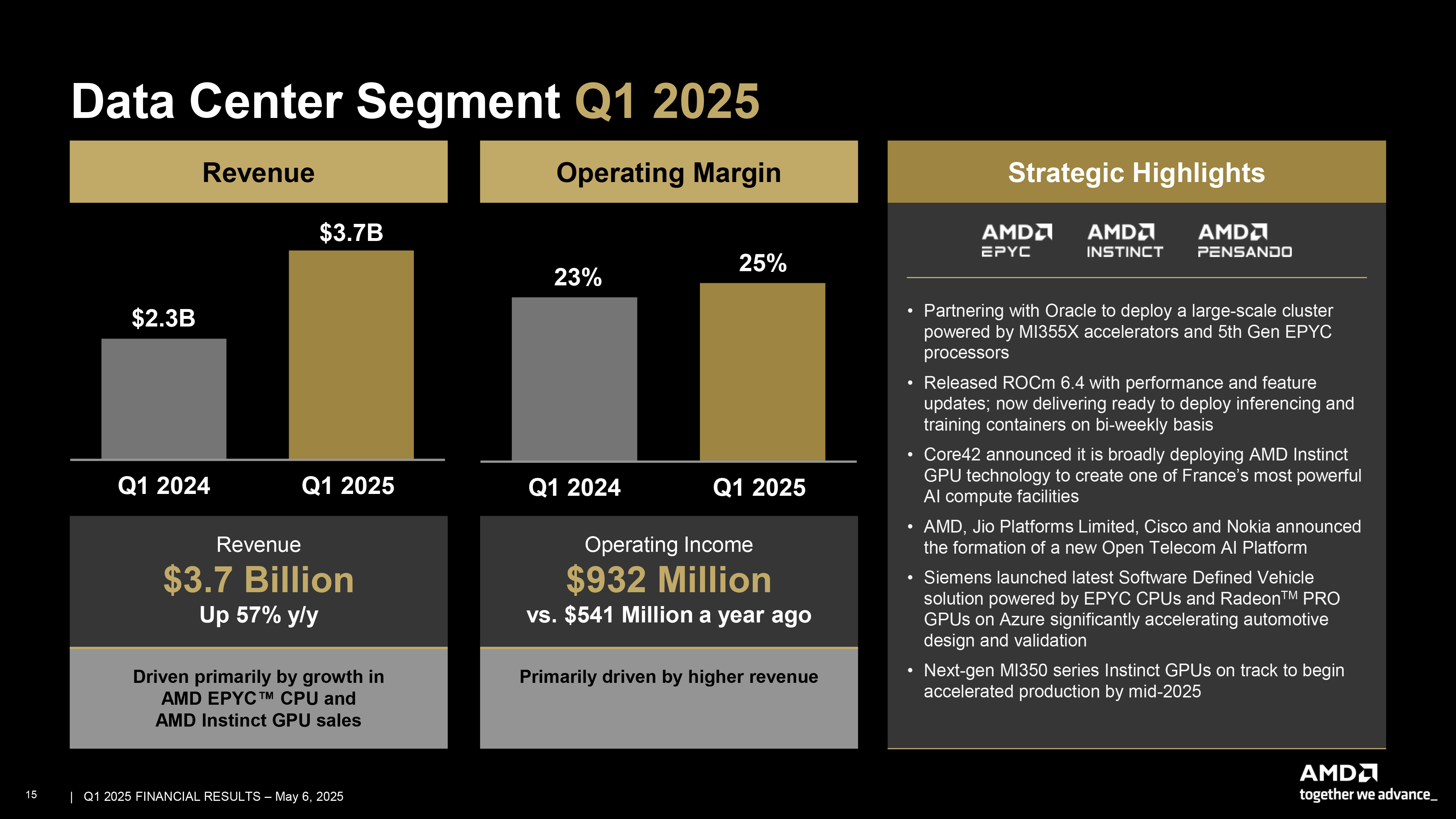

AMD's Data Center division reported $3.7 billion in revenue in Q1 2025, reflecting a 57% rise compared to the same quarter last year. This sharp increase was primarily fueled by continued momentum in server processor, particularly the 5th Generation EPYC CPUs. Nonetheless, AMD says that sales of its Instinct MI300-series accelerators for AI also inreased. Specifically, AMD, highlighted new deployments of of its AI GPUs with Core42, Oracle, and Siemens.

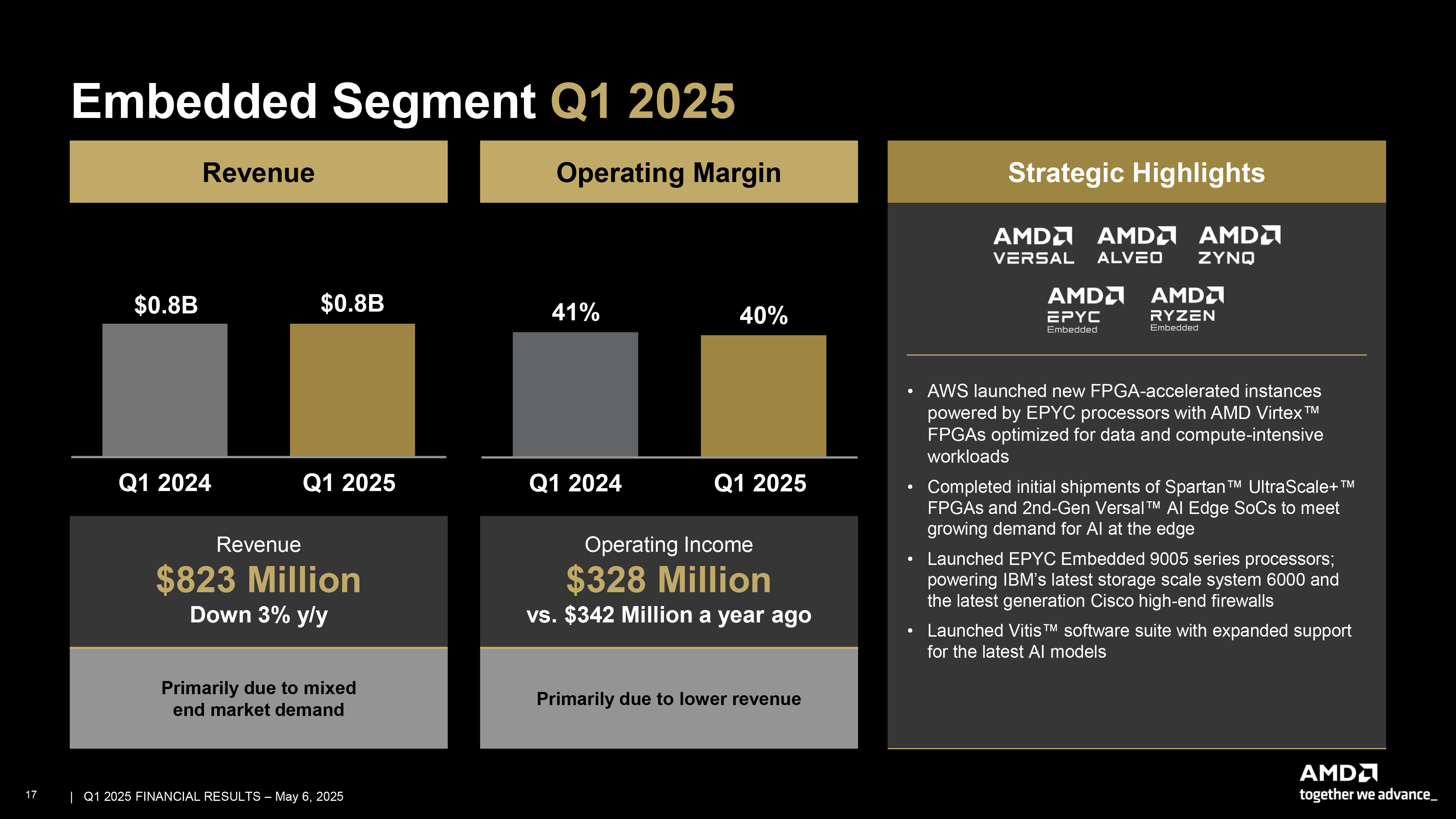

AMD's Embedded products unit generated $823 million in the first quarter, a 3% decrease from the prior year. This decline reflected varied conditions across end markets, with some areas showing strength while others struggling. Specifically, the launch of the EPYC Embedded 9005 processors, which are being integrated into IBM's latest storage systems and Cisco's high-end network security appliances, positively affected performance of the division. In addition, AMD also began shipments of Spartan UltraScale+ FPGAs and second-generation Versal AI Edge SoCs. However, demand for other products was a mixed bag.

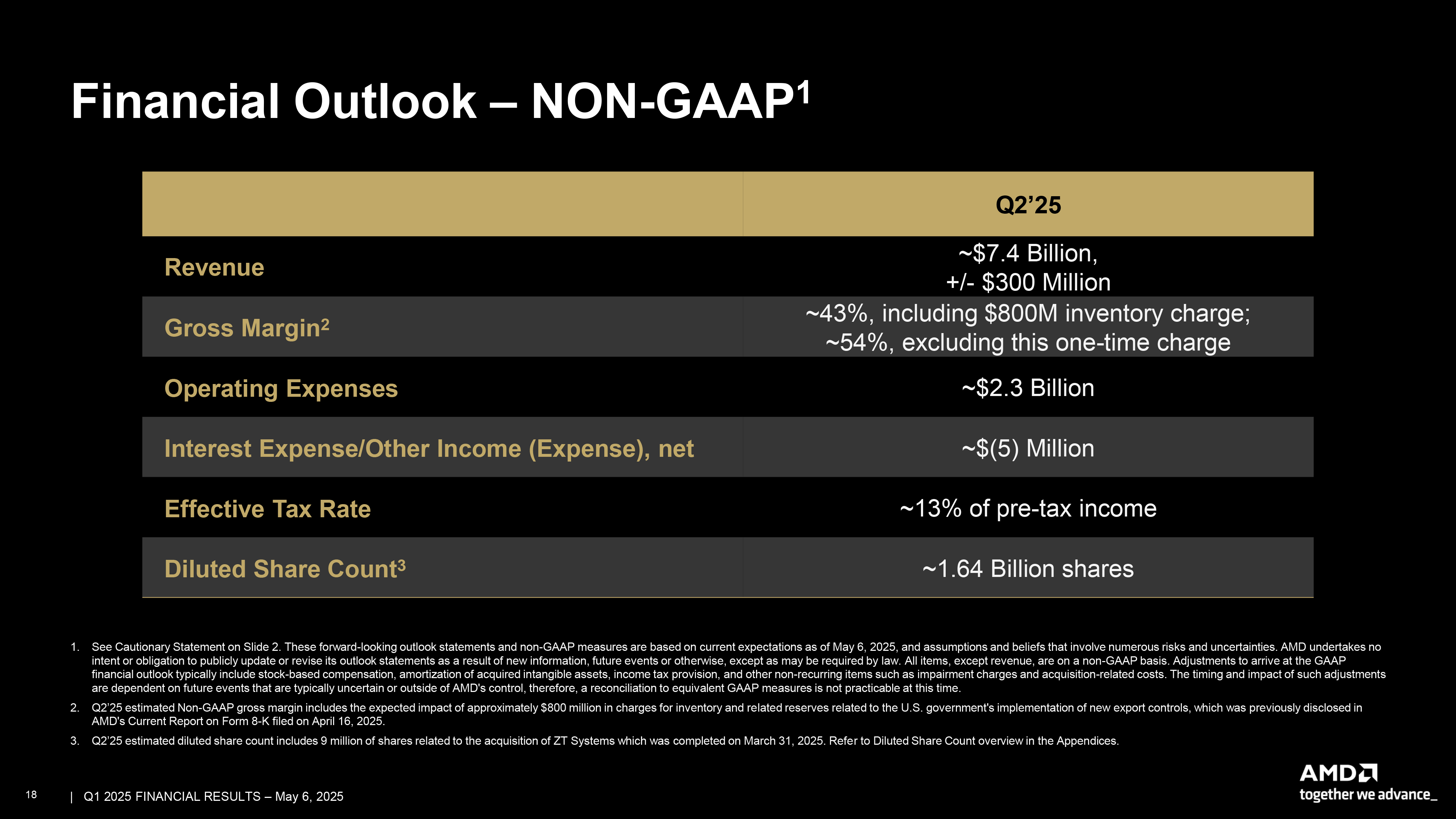

Looking ahead to the second quarter of 2025, AMD anticipates revenue to be around $7.4 billion ±$300 million. However, the company's profitability is expected to be impacted by a one-time $800 million inventory-related charge tied to the recently imposed U.S. export controls, which will lower the reported gross margin to around 43%. Without this adjustment, the gross margin would be around 54%.

7 months ago

91

7 months ago

91

English (US) ·

English (US) ·